This article is a continuation of “Growth Strategy: How to Increase Value Without Falling Into a Debt Trap” article by ink Advisory.

The investment appeal of a company is built on an effective business model, a well-thought-out growth strategy, sustainable and transparent processes, and a strong motivated team. Bringing aboard an investor and having a win-win deal requires comprehensive preparation that covers strategy, operations, corporate governance, and financial transparency. This process takes time and attention to detail, which is why it should begin well before the company reaches out to the investment community.

Bringing in an investor is a strategic step that provides the company with capital for scaling, entering new markets, and driving technological transformation. It also grants access to managerial expertise, business networks, and modern management practices.

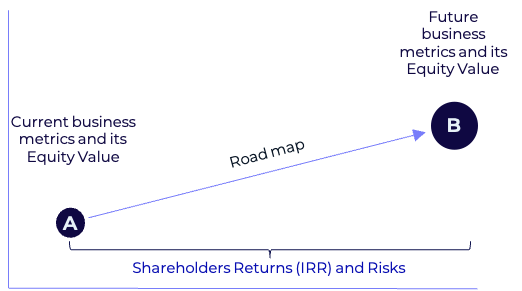

A win-win deal with investor means that valuation of the business at entry is favorable for the founder, and at the same time this investor sees enough evidence suggesting an even higher valuation in the future. To get to this point preparation must start long before the investment community.

This is a comprehensive process that includes two separate tracks:

The level of preparedness for the investment process is a great indicator of the company’s maturity. A proper preparation of the company also: (i) helps build trust in the founder and top managers; (ii) reduces perceived risks, associated with the company and the investment; (iii) strengthens the founder’s bargaining position; (iv) clearly demonstrates that the raised capital will work towards achieving strategic goals and increasing shareholder value.

When considering investment opportunities, investors evaluate not only past and current achievements of target companies – financial performance, market share, growth dynamics, sustainability of competitive advantages, and the quality of the management team – but also strategic direction.

What matters is not only the company’s strategic intentions, but also its ability to translate intentions into concrete actions – building the necessary infrastructure for growth, securing resources, strengthening the team, and maintaining discipline in achieving objectives.

On the one hand, the company must communicate its strategic goals to investors, and on the other hand – present a roadmap describing how it intends to achieve those goals and what resources will be required.

Beyond identifying the sources of growth, the strategy must also address the fundamental questions:

The strategy is authored by the management team jointly with the owner, ensuring a shared vision of the future and forming an investment rationale for the growth strategy.

| Element | What matters to the investor? | Questions the company must address |

|---|---|---|

| Market (TAM, SAM, SOM) | Market size, its boundaries, segments accessible to the company, and target segments | What are the market size and dynamics – TAM, SAM, and SOM? What data sources were used and why? Which segments are the most promising and why? What technological changes and trends are shaping the market and target segments? |

| Segmentation and growth drivers | Dynamics of key segments and factors influencing demand | Which segments are experiencing active growth? What factors drive demand? What opportunities and threats exist? |

| Market life cycle stage | Assessment of segment prospects: is the market in growth stage, maturity, or decline | At what stage of the life cycle are the chosen segments? How does this affect the company strategy? What new niches are emerging? |

| Company’s market position | Current market share, ability to gain and retain a significant share | In which segments does the company already have strong positions? What is its current market share? Which competitive advantages allow it to maintain these positions? How does the company defend its market share? What are its weak points? |

| Competitive environment and analysis of players | Intensity of competition and balance of forces among market players | How intense is competition within the segment? Who are the main competitors? What are their market shares and strategies? What competitive advantages does the company and its competitors have? |

| Industry structure and competitive forces | Threats of new entrants, substitutes, and the bargaining power of buyers and suppliers | Is there a threat of new entrants? What are the entry barriers? Is there a risk of substitutes emerging? How strong is the bargaining power of buyers and suppliers? What factors affect industry profitability? |

| Strategic outlook | Scalability and growth potential of the company in selected markets | What resources are needed to increase market share? Does the company plan to expand into new segments or regions? What countermeasures might competitors take? |

| Element | What matters to the investor? | Questions the company must address |

|---|---|---|

| 1. Customers segments | Scale and attractiveness of target segments, their dynamics, and diversification of the client base | What are the company’s main segments and customers? How are sales distributed across segments and regions? Is there dependence on one or several large clients? |

| 2. Value Proposition | Level of product (service) differentiation, reasons why customers choose them, strength of competitive advantages | Why do customers choose company products? Which factors are most important for them – price, quality, delivery speed, reliability? What advantages/ barriers protect the company against competitors? |

| 3. Channels | Effectiveness of distribution and communication channels and their scalability for sales growth | Through which channels does the company sell its products? Which channels generate the highest share of sales? Which communication channels are the most effective? |

| 4. Customer Relationships | Long-term relationships and predictability of demand, client retention, and repeat sales | What share of sales comes from long-term contracts? How does the company retain key clients? What does cohort analysis show regarding retention/ repeat purchases? |

| 5. Revenue Streams | Structure and predictability of sales, profitability of business lines, pricing policy | Which products or business lines generate the main sales and margins? How is revenue distributed by segment? How does pricing compare to competitors? |

| 6. Key resources | Adequacy of capacities, technologies, and human resources to support scaling and operational sustainability | What are the company’s current capacities and their utilization? How easily can capacity be scaled? What technologies, competencies, and patents underpin the business model? |

| 7. Key activities | Efficiency of key processes and their scalability | Which processes are most critical for implementing unique advantages and maintaining competitiveness? Which processes are key for scaling growth? |

| 8. Key partners | Reliability of the supply chain, diversification of suppliers, and sustainability of partnerships | Who are the key suppliers and partners? What is the level of dependency on them, and are there alternatives? How does the company manage risks of short-term or long-term supply disruption? |

| 9. Cost structure | Fixed and variable costs, potential for improving efficiency | What are the main cost items? What opportunities exist for optimization and efficiency improvement? |

Here, the dynamics of key indicators over the last 3–5 years are particularly important. For investors this serves as a kind of “reality check” – whether the business model truly works and is scalable. The main indicators of interest to investors cover several areas.

First and foremost is the

Equally important is the

An important area is the

| Element | What matters to the investor? | Questions the company must address |

|---|---|---|

| Scale and business dynamics | Scale of the business and performance dynamics, sustainability of growth | How have sales changed over the past 3–5 years: overall and by business lines? Which areas generate the highest sales growth and margins? |

| Customer base sustainability | Quality and diversification of the customer base, confirming demand stability | What is the level of customer retention? What share comes from repeat sales? What does cohort analysis show: is the average ticket growing and is retention improving across customer groups? |

| Operational profitability | Ability to manage costs and scale the business without losing quality and margins | What measures have been taken to manage cost of goods sold and variable expenses? How have productivity and quality changed? How have CAC, LTV, and ROI evolved? Which channels proved most effective? |

| Financial position, capital structure, net income | Balance sheet sustainability and ability to generate cash flows for debt servicing and growth, ensuring returns to company owners | What is the current Debt/EBITDA ratio? What was the Free Cash Flow? Are there liquidity reserves? How efficient is invested capital (IC)? How have net income and profitability changed in recent years? How is net profit allocated? |

| Management system | Level of company maturity as reflected in completed development projects and management improvements | What strategic steps have been implemented in recent years? How have they impacted the company’s market position? Which projects have been most effective? What is the quality of the company’s reporting and control systems? Are management decisions data-driven? |

How to prepare a company for successful equity raising? Strategic track. Part 2

Disclaimer

The information contained in this material is provided by INK ADVISORY Limited Liability Company (abbreviated legal name: LLC INK ADVISORY), OGRN 1247700655180, hereinafter referred to as ink Advisory and/or the Copyright Holder, including research results, forecasts, and fundamental analysis data, and does not constitute an individual investment recommendation.

The information herein should not be construed as a guarantee or promise of future investment returns, risk levels, cost amounts, or investment break-even. Past investment performance is not indicative of future results. This material is provided for informational purposes only and does not contain investment ideas, advice, recommendations, or offers to buy or sell financial instruments (including securities, other assets, or digital financial instruments).

The data presented is for reference purposes only and should not be regarded as a guarantee of income. Examples of investment performance are based on statistics for specific periods and do not reflect the dynamics of future returns. Analytical materials, reviews, and news articles by ink Advisory are intended solely to inform clients and do not constitute advertising of securities or other financial instruments. The information is based on public sources deemed reliable; however, ink Advisory does not guarantee its absolute accuracy and accepts no liability for possible inaccuracies or changes in the data.

Investing in securities involves risks and all investment decisions should be made independently by the investor, taking into account personal financial goals and acceptable risk levels. Even in the presence of positive assessments, conclusions should not be considered as investment recommendations. This material does not constitute an investment recommendation, offer or solicitation to buy or sell securities of MD Medical Group Investments (Mother and Child Group, MDMG) or the securities of any other companies. ink Advisory accepts no liability for any losses arising from the use of this material in making transactions or investment decisions.

Intellectual Property ProtectionThis article is protected by copyright. The exclusive rights to this article belong to ink Advisory. Quoting of the article is permitted in an amount not exceeding 30% of the original material, provided that the name of the Copyright Holder and the source are cited, along with an active hyperlink (for electronic resources) and the publication date of the original material. Any use of the article beyond quotation is allowed only with written permission from ink Advisory or with the attribution: «Exclusive rights to this material belong to ink Advisory».

Reproduction (full or partial) of materials beyond quotation for the purpose of commercialization is prohibited without the written consent of the Copyright Holder. This includes distribution, publication, adaptation or creation of derivative works, as well as use in mass media, analytical reports, or public presentations without proper source citation.

All materials, including analytical reviews, research reports, and news articles published on this resource, are the intellectual property of ink Advisory and are protected under the legislation of the Russian Federation. In case of violation of these conditions, the Copyright Holder reserves the right to seek protection of its rights.

More detailed information is provided in the User Agreement