Internal Rate of Return (IRR) – annual rate of return an owner receives from his or her investment, averaged over the life of investment. IRR is calculated on the basis of market value of equity share in the business. It reflects total return to the owner from both the growth in equity value and dividends received.

Why IRR is important for business owners:

IRR is best used in:

For a business owner,

How can an owner practically apply IRR calculation in a strategic decision-making process – to develop or to sell the business?

| Period | 0 | 1 | 2 | 3 | 4 | 5 |

|---|---|---|---|---|---|---|

| Equity Value | 10,0 | 12,0 | ||||

| Dividends | 1,0 | 1,0 | 1,0 | 1,0 | ||

| Shareholder Cash Flows (CF) | (10,0) | 1,0 | 1,0 | 1,0 | 1,0 | 12,0 |

| IRR | 11,6% | |||||

| Formula in MS Excel | = IRR (Shareholder CF) | |||||

where:

EqV0 – Equity Value at the beginning of the period;

EqVn – Equity Value at the end of the period;

y - Year number of ownership;

n - Total number of years of ownership (in case above – 5 years);

Dividends – Dividends received by the business owner in year y.

Consider an entrepreneur who owns a growing business. The company’s market is becoming saturated, competition is increasing, and it is expected that within the next five years the business will reach maturity and slow down – entering a plateau.

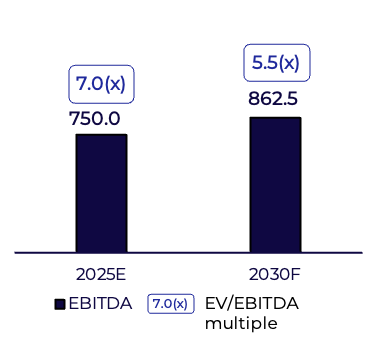

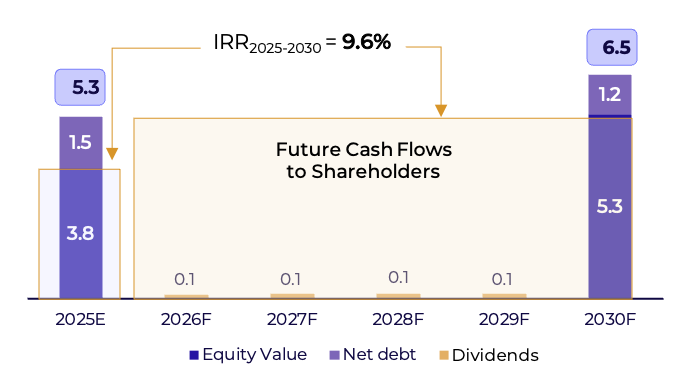

Assume that due to current market growth potential, the company is valued at 7.0x EV/EBITDA in 2025, or ₽3.8 b, based on an estimated EBITDA of ₽750 m in 2025 and net debt of ₽ 1.5 b.

In 2025, the business owner needs to choose between two options:

At first glance (see the table below), given the company’s growth, holding and selling the company in the future (2030) may appear to be justified.

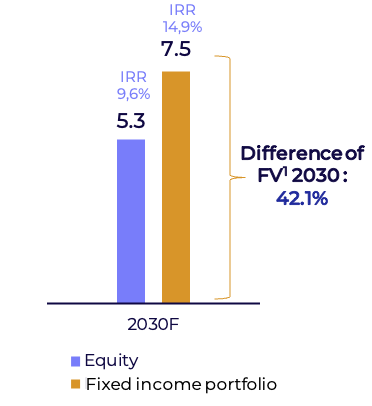

However, Option 2 – selling the business in 2025 – may actually be the preferable, even though the company’s financial metrics in 2030 are higher than in 2025.

| Criteria | Option 1 | Option 2 |

|---|---|---|

| Company business risks | Present until 2030 | No, the company is sold |

| Shareholder IRR (forward-looking until 2030) | 9,6% | 14,9% |

| Capital growth compared to the other option | Lower | Higher |

| Asset diversification | None | Capital diversified |

The business owner must take into account not only EBITDA, but also:

IRR helps determine whether it is more profitable to continue owning the business and earning income, or to sell it and invest in assets with higher expected returns.

| Year | 2025E | 2026F | 2027F | 2028F | 2029F | 2030F | CAGR 2025-2030 |

|---|---|---|---|---|---|---|---|

| Period | 0 | 1 | 2 | 3 | 4 | 5 | |

| Revenues | 5 000,0 | 5 750,0 | 6 612,5 | 7 273,8 | 8 001,1 | 8 401,2 | 10,9% |

| Growth rate | - | 15,0% | 15,0% | 10,0% | 10,0% | 5,0% | - |

| EBITDA[1] | 750,0 | 862,5 | 991,9 | 1 054,7 | 1 160,2 | 1 176,2 | 9,4% |

| EBITDA margin | 15,0% | 15,0% | 15,0% | 14,5% | 14,5% | 14,0% | - |

| Net profit | 250,0 | 287,5 | 297,6 | 327,3 | 360,1 | 378,1 | 8,6% |

| NP margin, % | 5,0% | 5,0% | 4,5% | 4,5% | 4,5% | 4,0% | - |

| Payout ratio, %[2] | 0,0% | 40,0% | 40,0% | 40,0% | 40,0% | 0,0% | - |

| Net Debt | 1 500,0 | 1 725,0 | 1 983,8 | 2 109,4 | 2 320,3 | 1 176,2 | -4,7% | Net Debt / EBITDA | 2,0(x) | 2,0(x) | 2,0(x) | 2,0(x) | 2,0(x) | 1,0(x) | - |

When selling the company in 2030 (holding period – 5 years) at a 7.0(x) EV/EBITDA multiple, its equity value is expected to reach ₽3.8 b. Taking into account the assumed dividend payout ratio of 40% in 2026–2029, the forward-looking IRR will be 9.6%.

To make an informed decision, the business owner should compare this scenario with the alternative – selling the company in 2025 and investing the proceeds in a diversified bond portfolio.

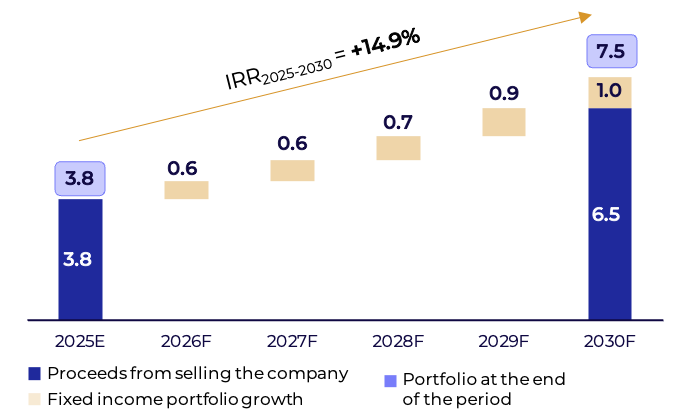

In this scenario, the business owner sells the company in 2025 (period 0) at a 7.0(x) EV/EBITDA multiple, or ₽3.8 b for 100% of the Equity.

The proceeds from the sale are invested in a diversified portfolio of securities, including high-quality corporate and government bonds, ETFs, and other reliable fixed income assets. For simplicity, we will consider a portfolio composed of AAA-rated corporate bonds, in which the owner invests over a five-year horizon.

The assumption is made that the funds are invested in bonds with coupon income reinvested over the five-year period. Under these conditions, the investment portfolio delivers an IRR of

Key assumptions of the fixed income portfolio (simplified approach):